The insurance industry is all about people.

From processing claims to answering policy questions, people are at the heart of this business. But the way those people interact with one another has drastically changed.

The old way of operating an insurance company is gone. Workforces are distributed across different locations and technology has changed the way people do things. This can lead to disparate sources of truth for your insurance documents, which oftentimes results in harmful data silos. But there's no need to abandon the progress and changes your company has made in recent years.

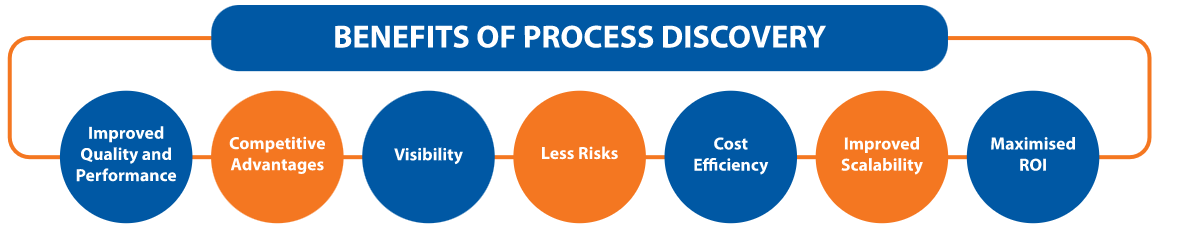

Instead, try conducting business process discovery across your organization. Breaking down your processes in order to judge what's working and what's not will undoubtedly improve any data silos your team is facing. Take a look at the steps we've outlined to get your organization started with process discovery. Plus, make sure you don't miss out on our downloadable checklist at the end of this article.

Source: EdgeVerve Systems

Step 1: Break Out Your Processes Step by Step

Every department within an insurance company has its own in-depth processes in place. All your departments serve vastly different purposes, yet are intrinsically connected, as insureds would not be able to receive coverage without each process in place. Consider evaluating processes in the following departments to ensure you have a clear understanding of how to enhance operational efficiency.

Underwriting — The insurance underwriting process involves sifting through loads of customer information and historical customer data in order to accurately assess risk. That means they likely need to log into different systems and portals to find and share the data they need. Keep tabs on how many separate logins this department is juggling.

Claims — Adjusters have a lengthy multi-step process model they need to follow in order to process a claim. Leverage a diagram or flowchart to make sure you have a clear understanding of each step your claims department takes in this process.

Call Center — Your support teams have to answer calls from insurance holders every day. There's no way of anticipating how broad or complex those questions may be, meaning they need access to all of your company's policies and manuals. Take stock of just how many systems they need to sift through in order to find the right answers for customers.

Sales/Marketing — This team needs to call customers frequently to gather information during the insurance quoting process. Sometimes this process involves multiple rounds of phone calls, which can lead to application dropouts. Study records of these phone calls to compile best practices to speed this process up.

Step 2: Assess Time Spent on Each Process

Each of your department's processes have multiple, necessary steps that need to be executed in order to be successful. But the odds are that some of those steps are tedious tasks slowing your team down. Those will make your organization less efficient, costing your company more money.

You've already broken out each of your processes department-by-department. Examine which tasks are not the best use of your employees' time.

Take the claims process. There's a lot that goes on in between receiving a claim and acting on it. Consider the time it takes to collect information from both the insured and the carrier.

These tasks are monotonous, time consuming and are sometimes prone to human error. Reevaluate each of your business processes so you can cut down on those tasks.

Track how long each of them takes. Finding ways to cut down time where you can will allow your employees more time to build stronger relationships with their clients. That means your insureds will get the coverage they really need.

Step 3: Learn How Each Process is Carried Out

The odds are there's one thing at the center of all your processes — technology. Insurance companies are notorious for operating on legacy systems. As the vast majority of the insurance workforce has been in the industry for years, employees have grown comfortable with those systems. But it's time to see where you can change things in order to give your team a comprehensive 360-degree view of your current data analysis and process documentation.

Those legacy systems are likely holding you back. While it does cost money to implement a new software solution, it's likely even more expensive to maintain your legacy system. On average, about 70% of insurers' IT budgets go toward keeping up those tools.

Not to mention that the older those tools get, the more expensive they will become to maintain. That means that the more you rely on those systems, the more they'll start to slow you down.

Just remember to select software solutions that put the employee experience first. Many insurance tools prioritize the customer experience and leave more work for insurance employees. As Forbes points out, an insurance policy holder can easily download an updated ID card from an app or website.

But that means that employees are left troubleshooting these digital channels for frustrated consumers. Remember that happy employees equal happy customers. Software solutions that allow employees to better do their job will lead to this outcome, so make sure you consider the impact of digital transformation on employees before starting on that journey.

Step 4: Determine Where You Can Automate

Insurance technology is the answer to streamlining most of your business processes. But don't think of business process discovery as a prelude to an expensive and lengthy digital transformation strategy and process.

Instead, just starting focusing on insurance document automation software. Automating certain tedious tasks for your employees will free them up to work on more complex tasks. Consider the following tasks you can start with:

- The invoice generation process

- Claims intake

- Initial loss or damage estimation

- Disaster analysis

- Basic customer support messaging

- Predictive data

- Fraud detection

Organizational-wide automation will undoubtedly streamline your business operations. That, in turn, will break down the disparate sources of truth that cause data information silos across your organization.

Without those data silos, your team will be best equipped to serve your customers. Insurance is about people, after all. Break down the obstacles that are in the way of your team performing to the best of its abilities and you'll see the benefits in no time.