Congratulations! You've just implemented an insurance knowledge management solution.

It's a tool that'll serve every aspect of your business. Software like this will keep necessary onboarding documents in place to ensure new operations team members will get up-to-speed as quickly as possible.

It’ll also help agents/brokers find the most up-to-date policy guidelines. Overall, knowledge management tools will make your employees more productive, as it'll cut out countless hours of searching through drives and portals for important pieces of content.

However, this will be a big change for your team.

As with any change to your daily operations, you need to track the project success. In this article, we've outlined how to measure change management at every stage. Tracking these key performance indicators (KPIs) will help prepare you to scale your digital transformation beyond just knowledge management.

Metrics to Consider Prior to Digital Transformation

Your business needs to decide on necessary KPIs before you even begin the change management process. You need to know what's going to change and make sure everyone within your organization is aware and on board. Here are two preliminary change management metrics to consider:

Awareness and preparedness — You need to consider how this change will impact your employees. In order to be successful on this front, Zendesk recommends focusing on two things: awareness — making sure employees understand the change and preparedness — ensuring your team has the knowledge and bandwidth to adapt to that change.

Deploy employee surveys so you can see which department may need the most guidance during this process. For example, if you're implementing a new insurance knowledge management solution, your call center agents will likely be spending a lot of time in that solution. Because of that, your survey results may show they feel underprepared to learn a piece of new insurance technology. That will show you need to offer additional training opportunities for that department.

How well managers hold teams accountable — Change starts from the top down. Before beginning the digital transformation journey, call on your department heads to make sure they express the importance of this change to their teams. Arm them with the right context to share with their direct reports so everyone's on the same page.

Provide your department heads with talking points on the importance of adapting to this change. For your underwriting team, this might require those employees to conduct an internal content audit in order to ensure your knowledge management solution holds only the most relevant, updated pieces of content.

How to Measure Change Management

Success metrics will look different for different businesses. Here are a few to consider when adopting an insurance knowledge management system.

Employee Adoption — This metric is tied directly to the business value of your knowledge management tool. Work with your IT team to track metrics such as the volume of user logins, how many searches have been conducted, and how much content has been uploaded. If these numbers are low, you'll know there's an issue with the software or your employees haven't received enough training on how to use the tool.

New Content Created — Any knowledge management solution worth its salt will provide analytics that can give you insight into your insurance document needs, whether it be gaps in job aids or updates to policy templates. Start tracking the new content that comes from these findings. As long as it's high-quality content, the higher the number here, the better. Creating this content will help to improve your customer and employee experience.

Employee Feedback Surveys — You should be leveraging employee surveys all throughout this process. Not only should you survey employees before the change, but it's crucial to get their feedback during the process as well.

They’re the ones that will likely be using the knowledge management tool the most, so it’s vital that they're comfortable with it. You need to understand how employees in every department are adapting to the change. Providing a direct channel for employees to share their thoughts is the best way to get that feedback.

Speed of Resolution to Answers — Your operations team likely already tracks how long it takes to resolve customer queries. Without a knowledge management solution, it likely takes too long — just like the 97 minute phone call it took our CEO to get an answer about his insurance policy years ago. After your new solution has been implemented, keep tabs on the average time it takes for call center teams to resolve customer queries. You should start to see those numbers go down in no time.

What Comes Next?

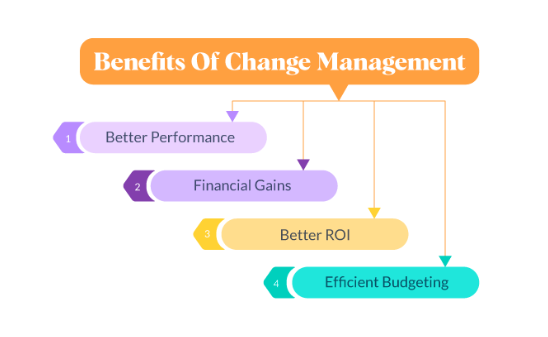

Source: Vantage Circle

Change shouldn't be a one-time event — it needs to be part of your company's DNA. Even after your knowledge management solution has been implemented and employees are fully comfortable with it, you should be continually monitoring the success and struggles your team has with it.

The insurance industry is in a constant state of change, meaning that this likely won't be the last time you implement a new software solution. Continue to maintain an optimistic outlook about the change within your organization, and your employees will follow suit.

Continue to keep them in the loop about upcoming changes and how they'll impact daily processes. You can consider implementing insurance change management tools to continue to measure your progress. When you have the best handle on change within your insurance company, it will undoubtedly thrive.