Insurers offer a vast number of products and services.

With that comes an even larger number of accompanying policy manuals and various insurance documents. It’s often a data overload but valuable information lies deep within that content.

Today's insurance environment is extremely dynamic. Wordings are changed, binding authority is paused, and the number of exceptions keeps growing. Your employees will be happier and more productive with organization-wide knowledge management to make these documents easily accessible. Here are five tips to get your business started.

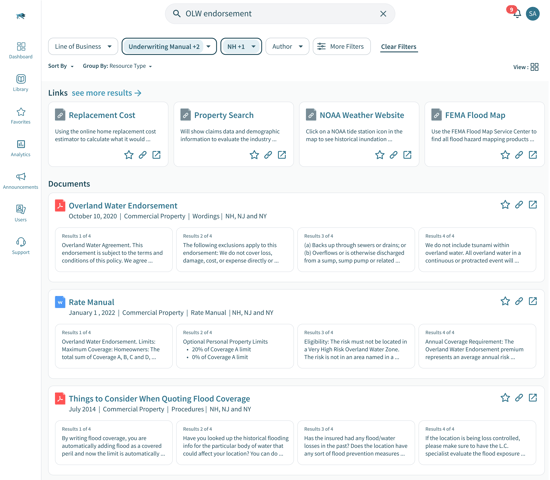

1. Implement an easily searchable insurance knowledge management solution

Insurance professionals simply spend too much time searching for answers on policy wordings, coverage options, endorsements, and general billing information. Those digital and paper documents can often get up to hundreds of pages long.

If those documents are stored in inaccessible locations, employees will waste time searching for the right answers. Specifically, as our data shows, up to one hour per day per person. Those hours could be better used building customer relationships and completing more complex tasks.

Consider implementing an AI-powered tool that learns the intent behind your search terms and internal acronyms to cut down your team's search time even further. (Psst…we might know a tool…)

2. Encourage knowledge sharing

While the impending retirement wave may cause some headaches for insurance companies, there is a silver lining to consider. The transition from seasoned brokers and underwriters to fresh-faced ones presents the opportunity to encourage knowledge sharing among your employees.

Before your company sees those employees retire, strive to make knowledge sharing part of your organizational values. Create time and space — whether it be virtual or physical — for more seasoned employees to share notes and account insights with newer employees.

This will eliminate any knowledge gaps when those employees retire and get the next wave of your workforce in the habit of sharing knowledge across teams.

3. Conduct regular content audits

Make it a point to regularly keep tabs on your existing internal content. Start by making a categorized list of the content your team uses on a daily basis. This might include job aids, underwriting guidelines, policy wordings, and whatever else you have.

Identify content that is out of date or no longer relevant. Determine which content should be updated or removed from your library in general. Make an organization-wide announcement to inform your team members when changes have been made to content. A tool like ProNavigator offers a central announcement center so you can easily share these updates with your team.

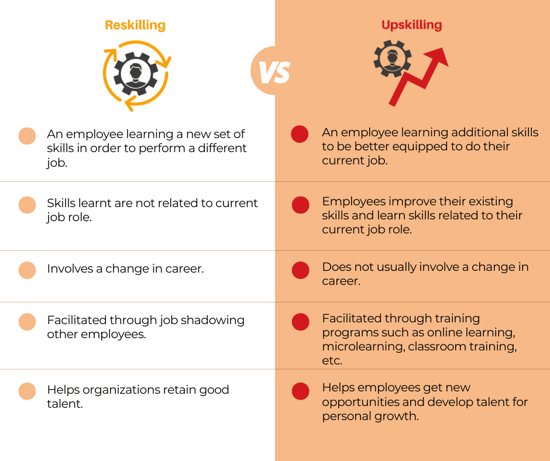

4. Reskill and upskill your workforce

Source: Whatfix

While most of the insurance workforce didn’t come up in the industry with technology as a job resource, it’s never too late to learn. Not only are people willing to do so, but they want to. In fact, a 2021 survey from BCG states that 71% of insurance employees are willing to reskill.

Provide your employees with training opportunities so they feel comfortable working with digital document management software. Make sure they understand how to upload content and search within the platform. This will help to boost employee engagement and productivity across all departments. Not to mention, it’ll help your company begin to eliminate data silos.

5. Check in on your progress

Knowledge management is an important step in improving your company’s productivity. But if it’s not done effectively, you’re not going to reap any of the benefits of this valuable business process. You should regularly check in with your employees and take note of any challenges they face.

On the flip side, survey your team members to learn the ways in which the new knowledge base has made their jobs easier. Learn from both so you can scale your knowledge management program.

If your employees can quickly access relevant content, they’ll be able to plainly explain complex policy wordings to their clients. That, in turn, will increase both employee and insurance consumer satisfaction.